What is UPI 2.0 ?

- National Payment Corporation of India has launched UPI system.

- UPI 2.0 is Upgraded version of the UPI 1.0 (Old UPI).

- First we under stand that what is UPI. UPI full form is Unified Payments Interface.

- UPI is the interface or system that provide bank to bank money transfer to normal public to merchant and any bank to bank account.

- UPI is money transfer system.

- UPI is very fastest system to transfer money form bank to bank. UPI allows multiple bank account in single mobile application.

- UPI is support in all transaction application like Google Pay, Phone Pay, Paytm, Amazon, Bharat Pay and and many more.

- UPI 2.0 is coming with many useful features that we will discuss in later in this article.

- UPI is developed by Government of INDIA.

What is the major reason for popularity of UPI system?

- Simple and easy to use

- Efficient to use

- Bank to bank tarnsfer with zero cost

- Fast to working

- UPI is available for 24(7).

UPI 2.0 Features

- UPI Lite

- In UPI lite offline transaction is available.

- The upper limit of UPI 2.0 is 200 Rs.

- The total limit of UPI 2.0 is 2000 Rs at any point of time.

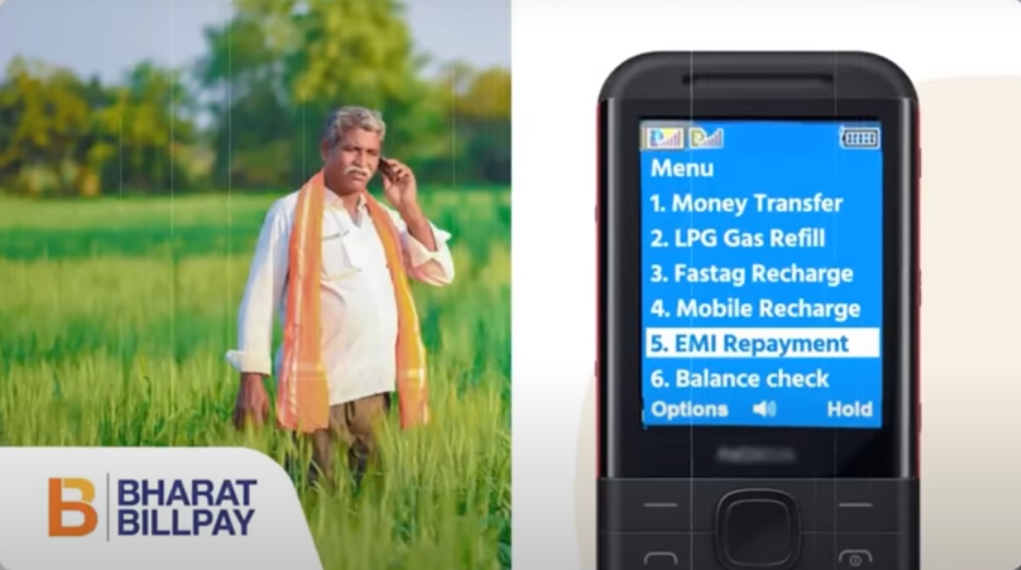

- UPI 123PAY

- In this system user can offline and smart phone transaction using keypad phone.

- In this 123PAY User has to call on IVR(Interactive Voice Response) number and using many option user can do money transfer.

- UPI + Credit Card

- In UPI 2.0 user are able to add credit card on UPI transaction, that means we can do payment using credit card in UPI 2.0 system.

Which other Country is using to UPI?

- On September 13, 2021, NPCL signed an agreement with many countries like below.

- Nepal

- Singapore

- Bhutan

- Malaysia

- UAE

- France

- United Kingdom

- South Coria

- Japan

- Oman

- Taiwan

- Hong Kong

- Vietnam

- Philippines

UPI 1.0 Vs UPI 2.0

- UPI 1.0 is not supported to given all feature is available in UPI 2.0 that is the main difference in UPI 1.0 and UPI 2.0.

Important Articles Link for reading

Comments

Post a Comment

If you have any doubts please feel to free and comment and ask to questions.